Vietnam is a stable and strategic destination for international trade, offering substantial growth opportunities for foreign investors. Business leaders must navigate complex regulations to structure investments for both operational success and future exit. This guide simplifies market complexity into a clear recruitment roadmap. It outlines how to select the right entry model, follow the market entry process, and implement governance to hire quickly while managing legal and financial risks. For foreign investors, a Vietnam market entry recruitment guide must connect ownership restrictions with the legal right to employ.

TL;DR

- Start with restrictions and structure, not vacancies: investment eligibility and foreign-ownership limits determine which hiring models are legally possible (JV vs 100% FOC, entity vs EOR), and shape payroll and IP control from day one.

- Plan for the full employer cost and tax pathway. Salaries should be budgeted alongside PIT withholding, social insurance, transfer pricing, and FX documentation to ensure smooth remittance of profits and shareholder loans.

- Scale quickly by partnering with governance-focused providers. Staff augmentation and Employer-of-Record models accelerate hiring while licensing is finalized. Sunbytes integrates recruitment with digital transformation and Secure by Design principles to build teams that align with your roadmap.

Why Vietnam?

The Vietnam Story

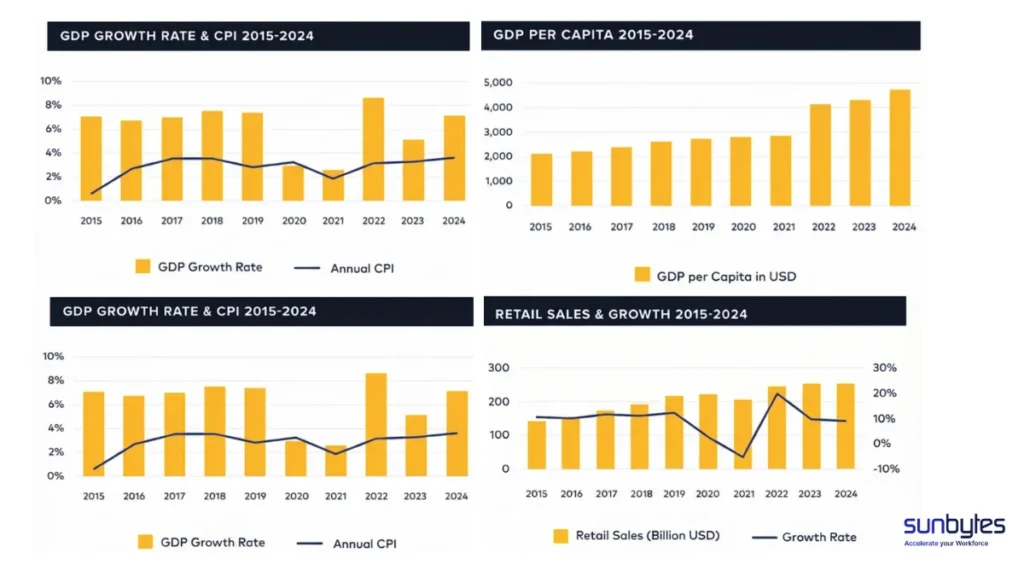

Vietnam has experienced tremendous growth since opening up to foreign investment in the late 1980s, transforming from an agrarian economy into a dynamic market with expanding tech, manufacturing, and services sectors. Today, it offers a large, young, digitally capable workforce ready to support global and regional operations.

Read more: Why is Vietnam the Next Hotspot for FDI

Foreign Investment Focus

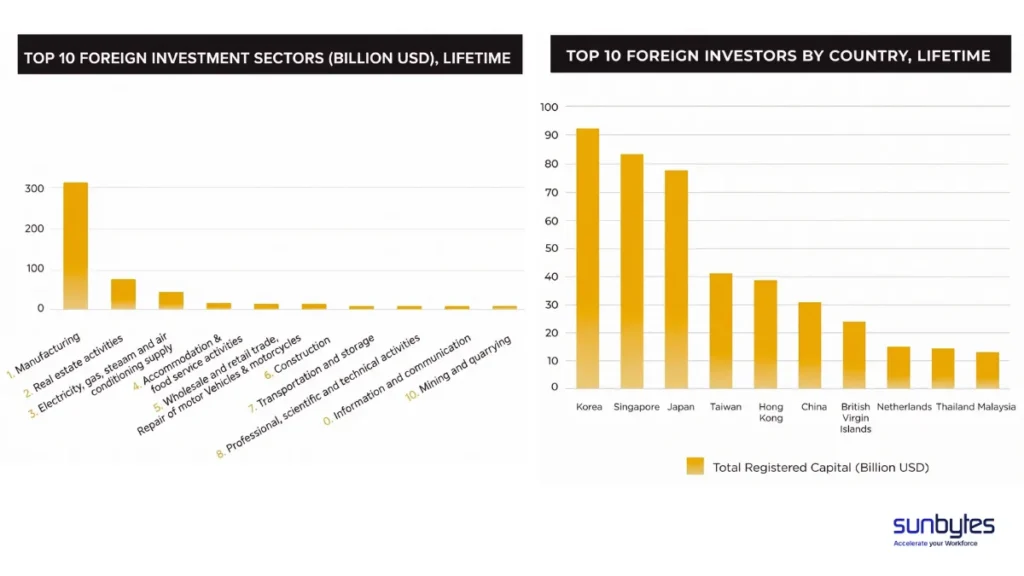

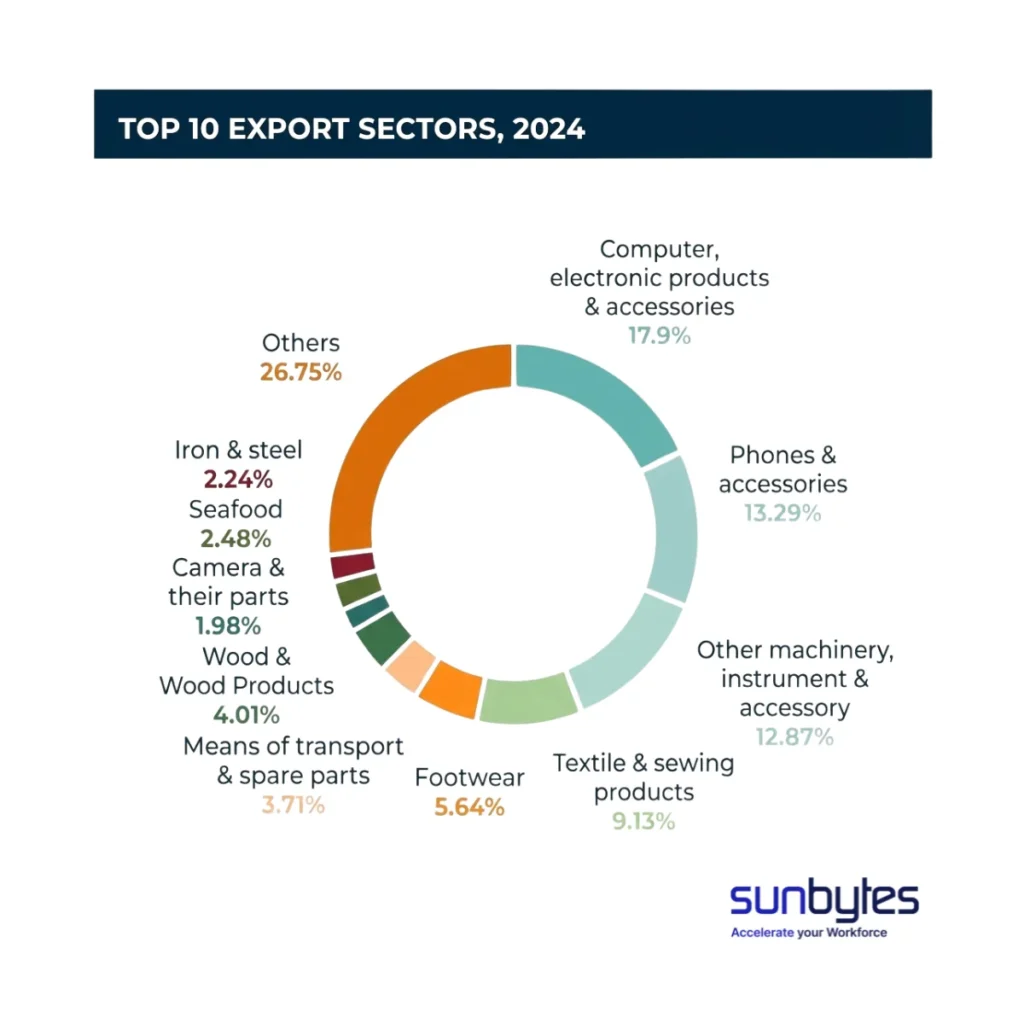

Vietnam’s economy is heavily driven by foreign investors. In 2024 (according to statistical information from the General Statistic Office dated 7 January 2025), foreign-invested enterprises accounted for 71.1% of all exported products, demonstrating how FDI shapes industrial capacity, export competitiveness, and demand for skilled talent.

Trade Connectivity

Vietnam’s trade footprint is broad and growing. It is a signatory to major trade agreements including:

- CPTPP (Comprehensive and Progressive Agreement for Trans-Pacific Partnership)

- RCEP (Regional Comprehensive Economic Partnership)

- EVFTA (EU-Vietnam Free Trade Agreement)

- UKVFTA (UK-Vietnam Free Trade Agreement)

In addition, Vietnam has concluded over 80 Double Tax Agreements, enhancing cross-border investment certainty and tax efficiency.

Stability

Relative political and economic stability positions Vietnam as a credible investment destination compared to other regional economies. For C-level leaders planning recruitment or market entry, this stability reduces geopolitical risk and supports long-term workforce planning.

Talent Advantage

Vietnam also boasts a young, tech-savvy workforce, aligning with global demand for digital, engineering, and professional services skills — all while offering competitive cost structures.

Options & Entry Strategies for Recruitment in Vietnam

Corporate Structures and Employment Models

Market entry options include a Representative Office, a Subsidiary, or a Branch. A Representative Offices (RO) may sign labor contracts under Vietnam’s Labor Code, but only for activities that support the parent company’s non-commercial functions. For operational roles tied to revenue generation or IP ownership, subsidiaries or licensed vehicles are required to act as the formal employer.Choosing between RO, Subsidiary, EOR, or Staff Augmentation should be treated as a governance decision rather than a pure time-to-hire choice

See the Entry Model Comparison for Hiring in Vietnam table for a detailed 1:1 overview of each option’s rights, speed, and control.

Entry Model Comparison for Hiring in Vietnam

| Entry option | Can sign labor contract? | Speed | IP control | Typical use |

| 100% FOC – Subsidiary | Yes after ERC | Medium | Full | Long-term operations |

| Joint Venture (JV) | Yes after ERC | Medium | Shared | Restricted sectors |

| EOR / Employer of Record | Via partner | Fastest | Limited | First hires |

| Representative Office | Yes – but limited to non-commercial functions of the parent company | Fast | None | Market test |

| Staff Augmentation | Via partner | Very fast | High by contract | Tech extension |

Tax Optimisation

Structures should also be based around optimising tax. This involves understanding opportunities with Double Tax Agreements, Transfer Pricing obligations and future plans of the investor. With an appropriate tax optimisation strategy, ongoing operations should have defensible compliance positions under future audits and inspections.

Capital & Treasury Management for Workforce Scaling

Remittance is essential. Inbound investment relies on the ability to repatriate profits, dividends, and shareholder loans within a compliant structure. While Vietnam enforces strict currency controls, these pose few challenges if investments are properly structured with clear FX, banking, and intercompany documentation. Defining a credible exit strategy early, including liquidation, divestment, and loan repayment, is critical to prevent capital from becoming trapped and to maintain financial flexibility.

Exit Strategies and Workforce Implications

Restructuring or exit creates obligations for notice periods, severance, and social insurance finalization. These should be anticipated during establishment, with contracts including flexible governance clauses.

During M&A or divestment, employment risks increase. Retention bonuses, policy integration, and transfer of labor records become sensitive issues. Inadequate preparation can reduce company valuation.

Developing adaptable recruitment strategies from the outset protects both employees and shareholders.

Read on our comprehensive guide on Entering a New Market: Strategy, Risks, and a Step-by-Step Guide for Successful Expansion

Market Entry Process and Recruitment in Vietnam

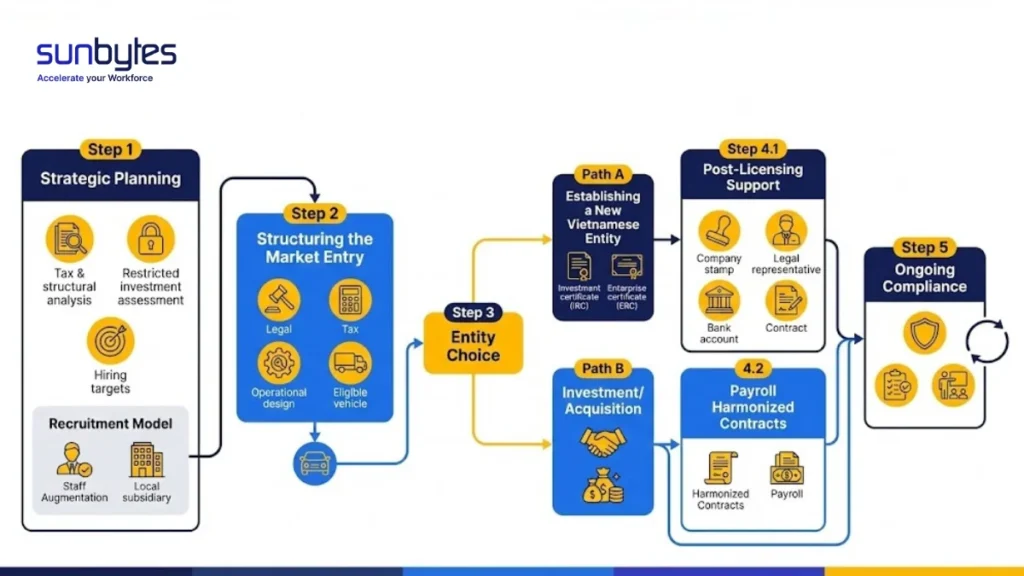

Step 1: Strategic Planning

Strategic planning in Vietnam should start with tax and structural analysis, as well as restricted investment assessment, before setting hiring targets. Organizations must review sector eligibility, since foreign ownership limits in certain industries determine which employment models are legally available, such as Joint Venture or 100% Foreign-Owned Enterprise. Once this foundation is established, leaders can define hiring objectives and translate them into achievable recruitment plans.

Choosing the appropriate recruitment model is a governance decision influenced by legal, tax, and IP considerations, not just time-to-hire. Many digital companies start with staff augmentation or Employer-of-Record solutions to test the market, then transition to a locally licensed subsidiary for long-term control once restrictions and tax structures are confirmed.

Read more: IT Staff Augmentation: A Complete Guide for Businesses

Read more: EOR vs. Entity setup in Viet Nam: 8 Critical Signs for Your Best Decision

Step 2: Structuring the Market Entry

Legal, tax, and operational design must mirror the business roadmap so that recruitment commitments are issued by an eligible vehicle. A company can only sign official labor contracts after obtaining the Enterprise Registration Certificate (ERC), making the distinction between licensing stages critical.

Option A: Establishing a New Vietnamese Entity

Step 3.1: Establishment of a New Vietnamese Entity

This stage confirms investment eligibility, charter capital, and sector approvals. During the IRC application, companies may identify candidates and conduct informal interviews, but binding employment agreements cannot be executed until the ERC is granted.

Step 4.1: Post-Licensing Support

Once the ERC is issued, corporate steps under the Law on Enterprises must come first. The initial post-licensing phase involves:

- Producing the company stamp,

- Appointing key personnel (legal representative, chief accountant if required),

- Establishing internal governance and the company bank account.

Only after these mandatory actions can organisations proceed to:

- Employment registration with labor authorities,

- Issuance of compliant bilingual labor contracts,

- Social insurance enrolment and payroll setup.

Documents such as the IRC and ERC are essential foundations for any labor contracts and HR processes.

Option B: Investment in or Acquisition of an Existing Enterprise

Step 3.2: Investment/Acquisition Considerations

Workforce due diligence remains the decisive risk filter. Historic tax liabilities in Vietnam are difficult to quantify and shield against, and for this reason, Sunbytes notes a common logic shift: it is often safer to establish a new entity to acquire assets of an existing business rather than purchasing its shares. This approach reduces exposure to uncertain legacy obligations while protecting retention planning.

Read more: Recruiting Strategies: 20 Proven Ways to Hire Top Talent in Vietnam

Step 4.2: Post-Transaction Support

After asset acquisition, companies must harmonise contracts, payroll, and HR policies with particular care for employee continuity, as cultural alignment strongly influences engagement and integration success.

Step 5: Ongoing Compliance and Workforce Governance

Labor law updates must be monitored continuously. Governance frameworks, regular audits, and training for line managers allow scale without increasing legal exposure.

Company Establishment

Overview of the Company Establishment Process

Establishment design determines how fast and how flexibly recruitment can operate. Executives should treat licensing as part of the talent strategy, as office address, legal representative, and charter capital evidence will directly affect eligibility to employ.

1. General Requirements

Legal Representative: At least one individual of any nationality who generally resides in Vietnam to act on behalf of the company.

Office Address: A valid registered office within Vietnam is required for both IRC and ERC applications and for later labor registrations.

Charter Capital: Evidence of financial capacity to remit the approved capital within 90 days from establishment, which will underpin payroll scale and benefits design.

2. Documents Required for Applications

Licensing, employment, and payroll documentation should be prepared early. Delays often result from incomplete bilingual contracts, benefit designs not aligned with legal requirements, and payroll systems missing statutory reports.

Read more: Payroll Compliance in Vietnam For Foreign Businesses

Market Entry Support – Transform, Accelerate & Secure

About Sunbytes

Sunbytes is a Dutch technology company headquartered in the Netherlands with a delivery hub in Vietnam. For 14 years, we have helped clients worldwide Transform · Secure · Accelerate, turning business strategy into reliable engineering delivery with security built in.

- Digital Transformation Solutions: design, build, and modernize digital products through senior teams covering custom development, QA/testing, and long-term maintenance & support.

- CyberSecurity Solutions: reduce risk without slowing delivery via practical security services and compliance readiness.

- Accelerate Workforce Solutions: expand capability and capacity with recruitment, payroll, and workforce governance support when growth demands it.

Recruitment in Vietnam with Sunbytes

With Sunbytes, you build a delivery-ready team that integrates seamlessly and grows with your vision and roadmap. You gain access to a talent ecosystem of over 30,000 professionals and flexible models. Speed is combined with governance through code quality standards, architecture alignment, and predictable metrics that protect IP and timelines.

Master Vietnam’s Labor Landscape navigating local regulations can be daunting. To help you stay ahead, we’ve compiled a comprehensive guide to hire legally in Vietnam. This guide covers all you need to know about hiring in Vietnam: Vietnam employment guide: how to hire and terminate staff legally

Tax Support

Sunbytes supports businesses entering Vietnam by providing employment-related tax structuring and cost predictability. Aligning allowances, bonus design, and cross-border recharge rules ensures tax planning supports the hiring strategy and remains transparent and defensible.

Compliance & Secure Operations

Labor law compliance and risk management are integrated into recruitment workflows. Governance frameworks for foreign employers, including contract templates, insurance registration, and audit trails, provide assurance for boards and regional headquarters.

Payroll Support

Accurate payroll, statutory reporting, and cross-border transparency ensure smooth operations during rapid scaling. Support for compliant HR processes enables growth with minimal administrative friction from day one.

Investment Considerations When Recruiting in Vietnam

Business leaders must balance talent availability and market saturation. Urban clusters provide depth but also competition. Wage inflation requires retention strategy and employer branding centered on learning and respectful leadership.

Localisation of management often outweighs expatriate dominance. Companies that empower Vietnamese leaders while maintaining global governance see stronger engagement and lower turnover.

Restrictions, Sectors & Strategic Workforce Planning

Some sectors involve foreign-ownership limits and licensing conditions that restrict employment forms. Sector-specific recruitment constraints may affect background checks, union dialogue, or benefit design.

Designing a compliant and future-proof hiring strategy means mapping labor law with product roadmap. Governance first, talent second – this sequence protects valuation and people alike.

Conclusion: Recruitment in Vietnam as a Strategic Advantage

Ready to Scale Your Team in Vietnam? A key factor in successful market entry is turning intent into a delivery-ready workforce. By selecting the right entry strategy and partner, leaders can scale their operations securely and effectively in Vietnam. Sunbytes helps foreign investors understand their options, processes, and employer requirements, delivering on both the structural and practical aspects of recruitment in Vietnam.

Don’t leave your market entry to chance. Book a Complimentary 30-Minute Consultation with our Vietnam market experts today to discuss your roadmap and hiring needs

FAQs

Staff augmentation / EOR partnerships are usually quickest while entity licensing is underway.

Yes for most employees; classification and caps must be designed carefully.

Use subsidiary contracts or embedded-team partners with governance frameworks and bilingual legal templates.

Let’s start with Sunbytes

Let us know your requirements for the team and we will contact you right away.