Scaling feels straightforward until rising talent costs, unpredictable spend, and slow hiring cycles start pushing your cost structure off balance. You feel the friction: the business is growing, but the economics behind it are getting harder to predict and control. Left unchecked, this becomes a hidden drag on pricing, reinvestment, and your ability to scale with confidence.

This guide clarifies what a cost structure actually is and how to optimise it, highlighting practical strategies used by fast-growing companies, including SaaS scale-ups in markets like the Netherlands, to build more predictable and scalable cost foundations.

TL;DR

- A business cost structure outlines all fixed, variable, direct, and indirect costs, and determines how efficiently you can scale.

- Fixed (salaries, rent), variable (usage-based cloud), direct (delivery or production), and indirect (HR, admin) costs behave differently and require different control mechanisms.

- Each industry has its own cost profile: manufacturing is asset-heavy, SaaS is talent + cloud intensive, retail is inventory-driven, consulting depends on billable expertise, and e-commerce blends logistics with fulfillment.

- To optimise, conduct a full cost audit, implement governance (e.g., FinOps), externalise selected fixed costs, and allocate capital to high-value activities.

- For scaling companies, especially SaaS players in markets like the Netherlands, shifting from local fixed hiring to dedicated nearshore/offshore teams converts rigid costs into predictable variable expenses while reducing overhead and operational risk.

What is a business cost structure?

A business cost structure is the blueprint of how your company spends money to operate, deliver value, and scale. It maps every expense: fixed costs like salaries and rent, and variable costs like cloud usage or production volume, so you can understand what drives your spending and how it changes as you grow.

More than a cost-cutting tool, a strong cost structure is a strategic design: it aligns spending with your value proposition, supports your revenue model, and provides the financial clarity needed for confident, efficient scaling.

Why does cost structure matter when you scale?

A well-defined cost structure becomes increasingly important as your business grows because it directly influences how efficiently you can convert momentum into sustainable profitability. Here are the four reasons it matters:

- Profitability & Break-Even Point: Your fixed–variable cost mix determines how fast you reach break-even and how effectively additional revenue turns into profit. A leaner structure accelerates both.

- Pricing Strategy: Clear cost visibility allows you to price your product or services with confidence, protect margins, and maintain competitive positioning.

- Capital Efficiency: When scaling, every euro must work harder. An optimised cost structure frees up capital from overhead and reinvests it into high-ROI activities like product development or market expansion.

- Operational Leverage: A scalable business is one where revenue grows faster than costs. The right structure reduces the need for proportional hiring or infrastructure spend, creating healthier long-term economics.

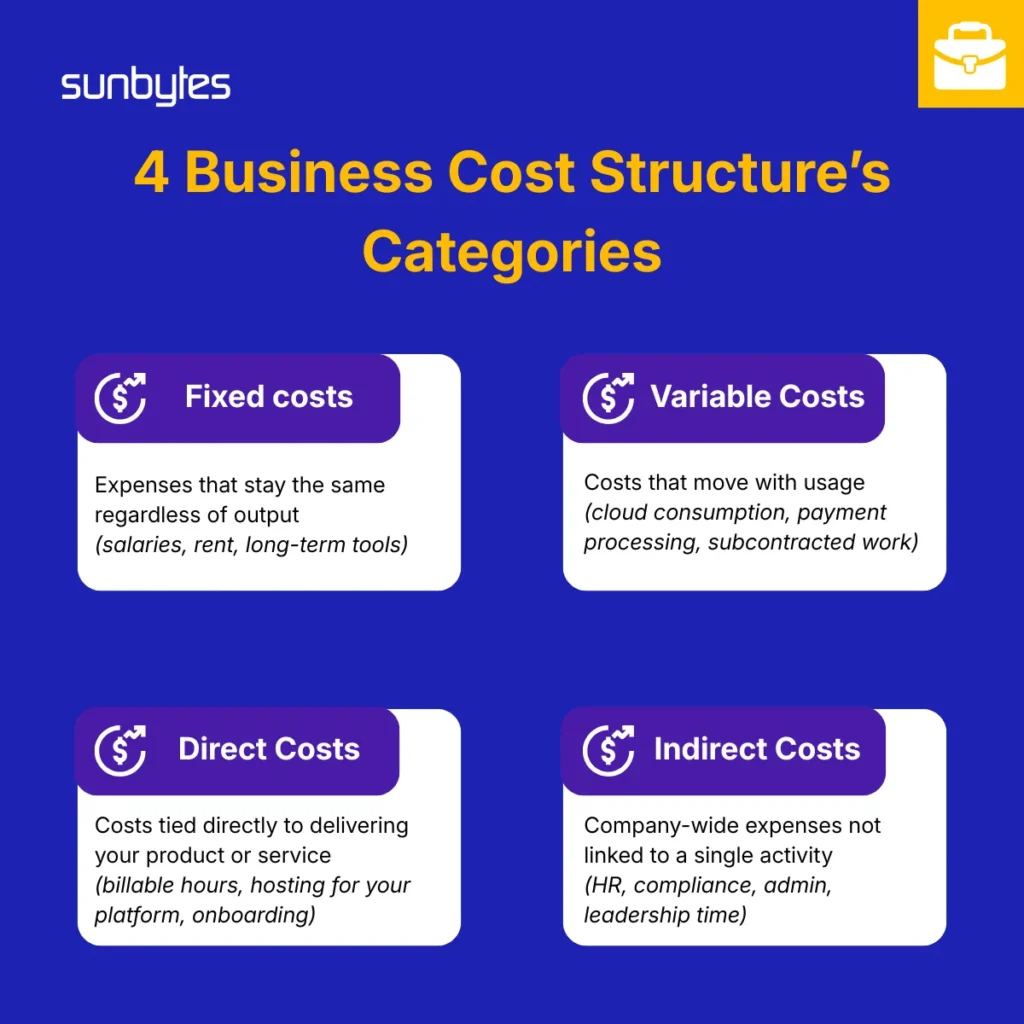

Business cost structure’s categories: Fixed, Variable, and beyond

A clear view of your cost categories helps you understand how your spending behaves as you grow and where leverage comes from.

- Fixed Costs: Expenses that stay the same regardless of output: salaries, rent, long-term tools. They provide stability but raise your break-even point.

- Variable Costs: Costs that move with usage or volume: cloud consumption, payment processing, subcontracted work. They keep your model flexible.

- Direct Costs: Costs tied directly to delivering your product or service: billable hours, hosting for your platform, onboarding. These define your true unit economics.

- Indirect Costs (Overhead): Company-wide expenses not linked to a single activity: HR, compliance, admin, leadership time. They scale quickly if not controlled.

These categories form the backbone of your cost structure and determine how efficiently your business can scale.

Selecting the right IT outsourcing model is a strategic decision that can directly impact project outcomes, cost efficiency, and long-term business resilience. CTOs, CEOs, and project managers must carefully align their project requirements with the most suitable model, considering factors such as scope, timeline, budget, control, and scalability. Below is a structured approach to guide this decision.

Business cost structure examples in different models

Different business models carry different cost dynamics, and understanding these patterns helps you benchmark your own structure more accurately.

- Manufacturing: Cost structure is asset-heavy, dominated by machinery, facilities, inventory, and labor, mostly fixed costs with high upfront investment.

- SaaS: Talent and cloud infrastructure are the main drivers. Fixed costs come from engineering teams; variable costs are tied to hosting, data usage, and support.

- Retail: Inventory, warehousing, and logistics define the structure. Margins depend heavily on volume, supplier pricing, and efficient distribution.

- Consulting: Costs scale with headcount. Talent is the product, so salaries are the dominant fixed cost, while utilisation rate drives revenue efficiency.

- E-commerce: A blend of digital and physical costs, technology, warehousing, last-mile delivery, and marketing (often a major variable expense).

If you want a quick refresher on how these business models work and examples of companies operating in each, explore our guide on the most popular business models and examples.

How to optimise your business cost structure for growth

Optimising your cost structure isn’t about cutting. it’s about redesigning how your company allocates resources so growth becomes more efficient, predictable, and capital-light. Four actions matter most:

- Perform a Full Cost Audit: Map every cost across fixed, variable, direct, and overhead categories. Identify which expenses drive value, which scale with revenue, and which create drag.

- Implement FinOps Governance: Apply structured governance to cloud and usage-based costs. Introduce visibility, accountability, and cost-control mechanisms to prevent spend from scaling faster than revenue.

- Strategically Externalise Fixed Costs: Shift selected functions—such as development or QA, from internal fixed salaries to dedicated nearshore/offshore teams. This converts rigid costs into predictable variable spend while reducing HR, recruitment, and infrastructure overhead.

- Focus Capital on Core Value: Reallocate savings to activities that directly accelerate growth, product innovation, revenue-generating initiatives, and market expansion, rather than supporting functions.

These steps help you build a cost structure that moves in sync with your growth curve, strengthens unit economics, and preserves capital for the areas that matter most.

Transforming fixed costs into predictable variable costs for Dutch scale-ups

As Dutch scale-ups push for sustainable, capital-efficient growth, the core challenge is redesigning the cost structure so it scales with the business instead of slowing it down. Many companies address this by adopting a dedicated nearshore/offshore team model, which shifts rigid local hiring expenses into predictable, flexible operating costs.

Addressing local talent costs

Dutch tech talent sits among the highest-cost labor markets in Europe. Leveraging dedicated nearshore/offshore teams provides access to specialised, high-quality developers without the Dutch salary premium. This immediately lowers one of your largest fixed cost drivers while maintaining delivery capability. The practical solution is a hybrid model, keep strategic leadership roles in-house and externalise execution-driven functions to a dedicated team that fully integrates with your processes.

For a real example, see how a Dutch SaaS scale-up reduced hiring pressure and expanded their product delivery.

Flexibility and predictability

Internal salaries behave as rigid fixed costs, scaling linearly with headcount and limiting your ability to adjust capacity. A dedicated team model replaces this rigidity with a predictable service agreement, turning salary-heavy expenses into controlled, optimised variable costs. This gives you clearer forecasting, faster decision-making, and the ability to scale up or down based on actual product demand rather than long-term payroll commitments. In effect, your cost structure becomes a flexible extension of your roadmap.

Capital preservation

Recruitment, onboarding, benefits, equipment, and office infrastructure quietly consume substantial capital that could otherwise accelerate product or market initiatives. Externalising these functions through dedicated teams preserves cash by removing non-essential internal overhead. This creates meaningful room to reinvest into high-ROI activities such as product innovation, GTM acceleration, or entering new markets. The result is a stronger runway, healthier unit economics, and a cost structure designed to support long-term strategic bets.

Risk mitigation

Local hiring brings operational responsibilities that expand as a company scales: HR management, legal compliance, labour regulations, workspace, equipment, and ongoing people operations. With a dedicated team partner, these risks and administrative burdens are handled externally, ensuring compliance, continuity, and delivery quality without the internal complexity. You maintain full control over strategy, priorities, and output while the partner manages the operational machinery behind the team.

Sunytes: A trusted partner in building scalable, cost-efficient teams

If you’re redesigning your cost structure for flexibility and predictable growth, the right partner can accelerate the shift.

Sunbytes combines 12+ years of experience, 300+ delivered projects, and recognition as an FD Gazelle in the Netherlands to help companies scale engineering capacity without adding fixed overhead. With an EU-led management team and strict ISO 27001, GDPR, and HIPAA compliance, we ensure every dedicated team is secure, reliable, and built for long-term performance.

Our model focuses on what matters most to scaling businesses: proactive technical guidance, efficient delivery control, deep technical expertise, fast scalability, and the ability to start from just 1 FTE. It’s a proven way to convert rigid hiring costs into a predictable, high-quality operating engine.

Ready to see how your cost structure could look with a dedicated team? Get a free consultation comparing Dedicated Team Cost vs. Local Hiring.

FAQs

1. What is a key analysis a CEO should perform on their cost structure?

Start with a fixed vs. variable cost analysis to understand which expenses scale with revenue and which remain rigid. Then identify which costs directly create value and which can be externalised or optimised without impacting performance.

2. How does outsourcing affect the ‘Fixed vs. Variable’ cost structure for a Dutch business?

Outsourcing converts salary-heavy fixed costs into predictable variable costs via a service agreement. For Dutch companies, where talent costs are high, this shift lowers overhead, increases flexibility, and improves forecasting accuracy while maintaining delivery capacity.

3. How does cost structure influence a company’s competitive advantage?

A well-designed cost structure strengthens pricing power, improves capital efficiency, and increases operational leverage, allowing you to scale faster than competitors. Companies that control their cost base can innovate more, invest earlier, and sustain healthier margins over time.

Let’s start with Sunbytes

Let us know your requirements for the team and we will contact you right away.